WHAT IT IS

A Donor Advised Charitable Gift Fund is a way to make tax-deductible gifts that enable you to support your local church, Christian Aid Ministries (CAM), and other charities of your choice, while protecting your privacy and simplifying your giving. There may be significant tax benefits in contributing real estate, securities, commodities, or mineral interests. You may also give cash or anything upon which a fair market value can be placed. CAM Foundation receives your primary gift as the sponsoring organization. As the donor, you may recommend to CAM Foundation when various smaller gifts from your Donor Advised Fund will be distributed to your church, CAM, or other charities who are in agreement with CAM Foundation’s statement of faith.

HOW IT WORKS

You donate cash or other assets with a fair market value to CAM Foundation. For example, the sale of a farm or business may produce unusually high income in the year in which the transaction is made. A cash donation will help reduce your taxes for the year in which you earned your income, but allow you to postpone distribution to charities until later. Or if the sale will generate significant capital gains taxes, you may consider contributing a portion of the farm or business to CAM Foundation prior to the sale. The buyer then purchases the farm or business from both you and CAM Foundation. The tax deduction from your donation may offset a significant portion or all of your capital gains taxes. In this way, proceeds from the sale that would otherwise go toward taxes are redirected to charities you wish to support. You may also generate a tax deduction by donating a portion of an oil and gas lease bonus payment, or you may assign royalties and in some cases mineral rights to a Donor Advised Fund.

Your gift represents an irrevocable contribution to CAM Foundation, a 501(c)(3) public charity, and is not refundable to you. CAM Foundation establishes and maintains a separately identified fund in the name you designate and manages the investment of your gift. These funds will be available for distribution to your church, to CAM, or to other legally registered 501(c)(3) charities. You may recommend disbursements at any time you wish throughout the year(s).

Please note that assets contributed to your Donor Advised Fund become the property of CAM Foundation, and the donor retains no legal control over the gift. Instead, you have the privilege to give non-binding advice to CAM Foundation concerning the distribution of the funds. Because CAM Foundation is a public charity, you get a tax deduction for the year in which you make the gift, even if not all of the funds are disbursed during that year.

WHAT IT COSTS

Generally CAM Foundation manages Donor Advised Funds without charge. In cases where it requires an unusual amounts of time or expense to receive or distribute, some costs may need to be covered by the Donor Advised Fund.

ADVANTAGES FOR DONORS

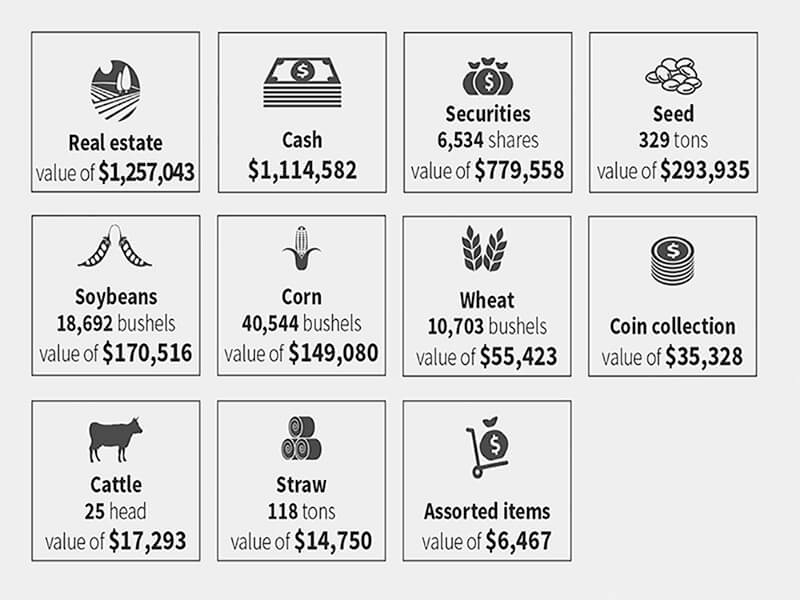

Flexibility—You can give a wide variety of assets: cash, real estate, business interests, securities, commodities, mineral interests, or anything upon which a fair market value can be placed. The fund can accommodate either a one-time gift or multiple gifts over time.

Simplicity—CAM Foundation takes responsibility to liquidate non-cash assets and to manage gift proceeds.

Reduce or eliminate capital gains tax—When appreciated real estate or securities are donated, the donor may not need to pay a portion or any of the tax on capital gains. This leaves more money to go to charity.

Tax benefits—CAM Foundation will issue a tax-

deductible receipt or an acknowlegement, depending on the type of gift. If your gift results in a federal income tax deduction, it may be applied against your taxable income, in some cases up to as much as 60 percent of your adjusted gross income (AGI). Unused portions of the deduction may be carried forward up to five successive years.

Option of “gift bundling”—With higher standard deductions for taxes starting in 2018, some individuals are choosing to bundle their giving in order to continue giving at the same levels as before. This means donating two or more years’ worth of giving at one time, claiming the charitable deduction that year, and then waiting that period of time to donate again. One way to bundle is by utilizing a DAF. This gives the person the option to bundle the donation to their DAF the first year and then continue to support their charity or church every year from the DAF.

Privacy—If the donor wishes to give anonymously, CAM Foundation can act as a screen between the donor and recipient charities.

Charitable gift reserve for emergency needs—Enables you to maintain a charitable gift reserve, so you can designate funds to charities for emergency needs that come up from time to time.

Accounting information—You receive a quarterly statement of your fund activity showing opening balance, amounts received, disbursements, and closing balance. More frequent statements may be requested at any time.

In 2019, CAM Foundation distributed funds to:

Churches — $653,859

Christian Aid Ministries — $737,484

Various-approved charities — $190,000

CASE STUDIES

Scenario one

John and his brother James own a manufacturing company and make charitable gifts from their business. However, they are unable to make monthly donations because they serve a seasonal market, so they calculate the amount of their gift at the end of the year. Since it is an annual lump sum, they wish to divide it out over the following year in smaller gifts to various charities. They split their annual donation into separate Donor Advised Funds and then each partner can make personal gift recommendations throughout the following year.

Scenario two

Jacob decides to sell the farm he purchased 25 years ago for $100,000. Today the fair market value for the farm is $500,000, which results in a capital gain of $400,000. He desires to give 10 percent of the gain to charity. John’s combined federal and state tax bracket is 35 percent and his capital gains tax bracket is 22 percent, which results in a capital gains tax liability of $88,000 when he sells the farm. After paying his capital gains taxes and gifting 10 percent of the gain ($40,000), he has a net amount of $372,000 left over before income taxes.

If Jacob gifts 35 percent of his farm to charity prior to the sale, he reduces his capital gain to $260,000 and his capital gains tax liability to $57,200. But by making this gift, he receives a charitable deduction of $175,000, the fair market value of his gift to charity, resulting in a tax deduction of $61,250 (based on his 35 percent tax bracket). This more than offsets the $57,200 capital gains tax on the sale of the farm. This way, Jacob ends up with $329,050 before income taxes, rather than $372,000, but is blessed with the satisfaction of having redirected a substantial amount of tax dollars to charity. While he has $42,950 less in proceeds from the sale, he has been able to leverage his giving and support God’s work by an additional $135,000.

Individual situations and tax brackets vary, producing different results. We will gladly review your situation and estimate the percentage of your farm or business that would need to be gifted to offset your capital gains taxes. You will not be under any obligation to make a gift or open a Donor Advised Fund. We recommend that you also consult with your accountant or tax planner.

These materials have been prepared for educational and informational purposes only. They are not legal advice nor legal opinions on any specific matters. Please consult your tax advisor.