A way to channel would-be tax dollars to kingdom work

Twenty-five years ago Jacob bought a farm for $200,000. Now his children are grown and have all left home. Jacob and his wife want to sell the farm and move to a smaller place.

Jacob knows he has several options:

Option 1: Sell the property and give a cash gift.

Today the fair market value of Jacob’s farm is $1,100,000. This results in a capital gain of $900,000. While he has tithed regularly on the income earned each year on the farm, he also wishes to give 10 percent of this gain in value to charity. Jacob’s combined federal and state tax bracket is 35 percent and his capital gains tax bracket is 23.8 percent, which results in a capital gains tax liability of $180,000 when he sells the farm. After paying his capital gains tax and gifting 10 percent of the gain, he has a net amount of $848,500 left over in the bank.

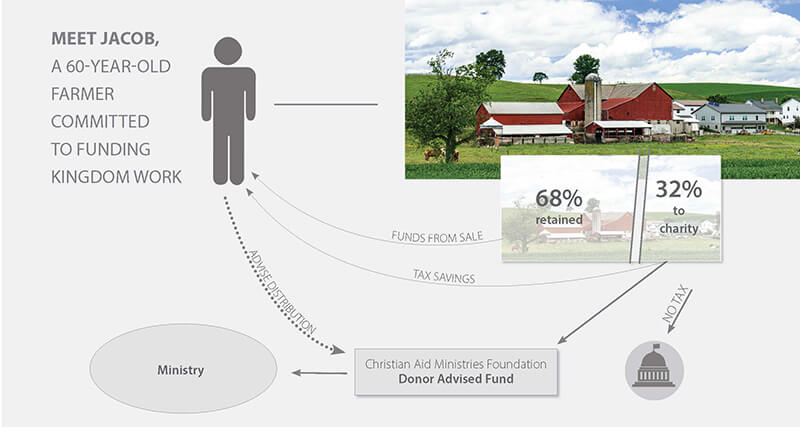

Option 2: Gift a portion of his property to a charitable organization prior to the sale. (See diagram.)

If Jacob makes a gift of 32 percent of his farm to a charitable organization prior to a sale, he reduces his capital gains from $900,000 to $612,000 and his capital gains tax liability from $180,000 to $122,400. But by making this gift, he receives a charitable deduction of $352,000, the fair market value of his gift to charity, resulting in a tax deduction of $260,000, based on his tax rates. This tax deduction more than offsets the $122,400 capital gains tax on the sale of the farm. This way, Jacob ends up with $748,800, rather than $848,500, but is blessed by having redirected a substantial amount of tax dollars to fund the Lord’s work instead. While he has $99,700 less in proceeds from the sale, he has been able to leverage his giving and fund the Lord’s work by an additional $262,000.

For many of us, the opportunity to make a gift to charity beyond our regular cash giving may occur only once or twice in our lifetime, generally when we make the sale of a major asset. Often these sales are highly appreciated properties where substantial capital gains tax is due. While cash gifts are essential for ministry, real estate and other kinds of property may also be donated to charity. Usually, a ministry cannot wait for the sale of a piece of property to fund systematic expenses. But when making one-time gifts, there is generally enough time to plan properly to take advantage of the tax savings made possible through a charitable gift.

While gifts of appreciated property provide significant tax benefits, saving taxes alone should not be the reason for your giving to charity. True giving is an expression of worship from the heart that loves God and cares for the needs of a lost and dying world. But with proper motives, a planned gift to maximize funds for charity by using tax laws available is good stewardship.

Capital Gains Tax—what exactly is it?

When you own property that has appreciated in value and you sell the property, you must pay tax on the difference between your tax basis in the property and what you received from the sale. This is the difference between what you paid for the property plus improvements, less depreciation, if any, and the sale price. This tax is called a capital gains tax. The capital gains tax rates range from 15 percent to 23.8 percent, plus state tax, if you held the property for one year or more.

Capital gains taxes are “optional”

Many are often not aware that capital gains tax is an optional tax, or at the least it can be minimized. There are three options when dealing with capital gains tax:

OPTION 1:

Pay the tax. Naturally, this is the most tax expensive option.

OPTION 2:

Postpone the tax. This can be accomplished through an exchange of real estate, under a special section of the tax code, or through an installment sale. Initially, this can be a way to reduce taxes. But the day of reckoning will come.

OPTION 3:

Avoid the tax. Capital gains tax can be avoided in two ways:

- By transferring the property through your estate at the time of your death. This is a heavy price to pay for the avoidance of any tax.

- By gifting all or some of your property to a charity during your lifetime. Gifting the entire property to charity prior to a sale completely avoids capital gains taxes. Or you could gift a portion of the property to charity, and sell the balance. Any buyer would then purchase the property from you and the charity. The deduction you receive from the gift to charity would offset all or part of the capital gains tax on the portion you sell. This is made possible by gifting property prior to the sale rather than cash after the sale.

What is the difference between giving property or cash?

When you transfer all or part of appreciated property to a charitable organization prior to making a sale, your charitable deduction is based on the fair market value of the property at the time of the transfer. However, if you sell the property and then make the gift to charity, you will be taxed on the appreciation, and owe capital gains tax to the government. But that tax is reduced or avoided when you gift all or part of appreciated property directly to the charitable organization prior to the sale.

Donor advised charitable gift fund—a way to distribute the proceeds from your gift

If you make a planned gift of this type to Christian Aid Ministries Foundation, the proceeds will be placed into a donor advised fund with us. This will enable you to distribute the proceeds from your gift to your church, to Christian Aid Ministries for use in our programs, or to other charities you wish to support.

Some things to remember

In this newsletter, it is not possible to cover all the specifics relating to taxation of gifts of property. But there are some general rules to remember:

- Gifts of cash or non-appreciated property may be deductible up to 60 percent of your adjusted gross income (AGI). But if you make a gift of appreciated property, that deduction is limited to 30 percent of AGI. However, if the deduction from your gift exceeds the amount you can deduct in one year, the balance of the deduction can be carried forward an additional five years, and used to offset taxes in subsequent years.

- Even though a property has appreciated in value, it must have been held one year or longer, or the deduction will be for the cost basis, rather than the fair market value.

- Other types of property, such as stocks, bonds, mutual funds, and certain tangible personal property may also be gifted with the same effect.

Do you want to know more?

To learn more, contact Christian Aid Ministries Foundation at 330-893-4915 before you make a sales agreement. Individual situations and tax brackets vary, producing different results. We will gladly review your situation and calculate the percentage you would need to gift to charity to offset your capital gains taxes. You will not be under any obligation to make a gift. We do recommend that you also consult with your accountant and tax advisor.

NOTICE: These materials have been prepared for educational and informational purposes only. They are not legal advice nor legal opinions on any specific matters. You will need an attorney from your state to draft and execute your documents. You should also seek the counsel of your accountant or tax advisor.